In simple terms, APIs (application programming interfaces) enable two or more software products to interact with each other.

APIs are highly beneficial to any industry where you require real-time data, and the lending industry is no exception.

As an SME lender, you must operate in a highly competitive marketplace and meet the needs of your customers quickly and easily. Where legacy lending software are slow, have limited functionality, and are difficult to connect with, modern lending software are designed for connectivity.

In other words, an API and integration-friendly loan management solution allows SME lenders to access decisioning data from third-party providers in seconds, automate decisions, and deliver an exceptional customer experience. This means fewer costs and less time for you. And, of course, a better user experience for your borrowers.

The right mix of APIs can let your borrowers apply for loans, receive funds, repay loans, and monitor their status, all in a single platform.

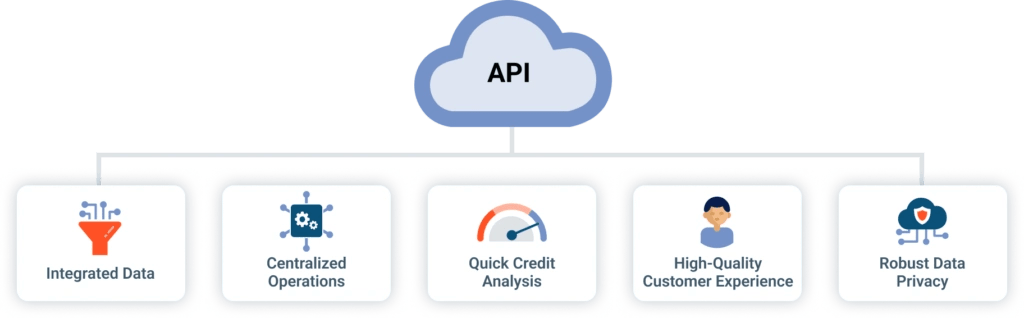

Benefits of APIs for Small Business Lenders

A lending software that uses APIs allows SME lenders to seamlessly connect the various stages of the lending process. Ultimately, this provides a complete and convenient experience for both lenders and borrowers.

Let’s get into the five key benefits of lending APIs.

1. Integrated Data

APIs allow lenders to bring together data from and between different stages of the lending process, saving the hassle of having to copy and paste data manually across multiple applications. This avoids unnecessary expenses on resources and eliminates human error altogether. For instance, if your sales and underwriting teams use distinct information systems, you could use an API to connect the systems, to enable customer data to flow completely and accurately.

2. Centralized Operations

APIs allow multiple third-party applications to interact and link with a centralized platform. This enables you to fill loan applications, perform creditworthiness checks, and disburse and collect loans from a single, unified platform. Centralized operations through a one-platform approach provide lenders with the tools necessary to eliminate workflow gaps, optimize stakeholder collaboration, and thrive in today’s evolving market.

3. Quick Credit Analysis

Agile financial organizations leverage real-time data to make calculated and informed decisions. Thanks to APIs, SME lenders can leverage multiple sources of comprehensive credit and financial data for scoring and risk assessment at a fraction of the cost. Even borrowers benefit, as deeper scoring models can utilize sophisticated formulae and leverage more types of data, which can result in more favorable rates.

4. High-Quality Customer Experience

By using a lending software that works with numerous APIs, lenders can provide an expanded range of products and services, extending the value of their core offering. For instance, APIs can automate the loan application process to allow SMEs to submit cashflow records and payroll information with just a few clicks, seamlessly connecting their lender with their bank. In a market where virtually all lenders offer competitive loan terms, providing the highest quality customer service could be what sets you apart from the pack.

5. Robust Data Privacy

The regulatory requirements of the CCPA and GDPR set increasingly robust standards concerning data privacy in API usage. Providers are required by law to set protocols that allow consumers transparency regarding the data shared and give them the ability to delete the data. As APIs automate data flow between applications, they allow lenders to better maintain data integrity and prevent data breaches. An added benefit of using APIs is that lenders can maintain full control of their data – lenders decide what data is shared and where it goes. With APIs, it also becomes easier to remove or delete data from multiple applications at once.

Types of Lending APIs

SME lending APIs cater to every stage of the lending cycle.

When potential borrowers approach you for a loan, you need to provide a personalized onboarding process and make it easy for them to engage with you throughout their journey.

Once approved, the loan needs to be disbursed to your borrowers’ accounts, and repayments collected according to the loan schedule. A well-integrated lending software will automate both these crucial aspects of the lending process.

Let’s take a look at the specific lending APIs you can leverage to automate and simplify your company’s lending process.

Onboarding APIs

Traditionally, borrowers experience a tedious and time-consuming onboarding process.

It could take weeks, as they have to fill in lengthy documents by hand, read and interpret legal and bank information, and wait for days to have the application processed by an underwriter.

With onboarding APIs, all of these steps are automated. Borrowers can complete their application minutes, as APIs pull their financial and credit history data and send it straight through to the underwriter.

The Onyx IQ Advantage: Our partners at MoneyThumb help us help you with their Optical Character Recognition (OCR) technology. You can electronically process handwritten and machine-coded documents, like pdf bank statements, right in Onyx IQ platform.

Credit Underwriting APIs

As a lender, you need to get information about the creditworthiness of your borrowers. This means looking up borrower financial and credit history from CIBIL and other alternate sources. Access to as much information as you can get about the entities you lend to will help drive efficient and factual decision-making. With the help of credit underwriting APIs, you can extract entity credit history within seconds at a fraction of the cost of having to look up this information manually.

The Onyx IQ Advantage: Our platform integrates with Experian to pull data instantly. Once extracted into our platform, it is hardcoded for easier access and data security. We also partner with Decision Logic and Thompson Reuter’s CLEAR to verify borrower identity and account details in real-time. Once pulled, you can access the data at any time and refresh existing reports from Experian, Thompson Reuter’s CLEAR, and Decision Logic.

Loan Fulfillment APIs

Loan disbursement is the next stage in the loan issuance process. Once the loan has been confirmed, a loan agreement needs to be signed by both the lender and the borrower, after which the loan would be disbursed as a transfer from the borrower’s account to the lender’s account. Using disparate legacy lending software to fulfill these functions can be time-consuming and expensive. If you’re still using legacy lending software for loan fulfillment, you’re spending more than you should and leaving money on the table!

Now thanks to APIs, agreement processing and document signing can be completed by both parties within minutes. As soon as it is verified within the lender’s central processing system, the loan is disbursed to the borrower.

The Onyx IQ advantage:

Use the DocuSign API on the Onyx IQ platform to get documents signed by your clients in just a couple of clicks! Moreover, thanks to our partners at Actum processing, you can also process loans through ACH transfers with industry-standard processing times.

Communication APIs

Thanks to communication APIs, you now no longer have to keep manual records of loan repayment schedules or chase clients yourself. Payment reminders are automatically sent through multiple channels to the borrower, and you’re notified when payments have been made or are past due. They also facilitate swifter transactions that are completely online and paperless.

The Onyx IQ advantage: When you use the Onyx IQ platform, you get access to Twilio’s automated SMS and email (Send Grid) services to send automatic and customized payment reminders to your borrowers.

Read more about Onyx IQ’s 16 (and counting) API integrations here.

Onyx IQ: We Partner With the Best

Digital transformation is driving alternative lending, and APIs are integral to becoming an agile SME lender.

At Onyx IQ, we partner with the best API providers to give the widest range of capabilities for you. Onyx IQ is an all-in-one digital lending platform designed to help you automate your lending process.

With our turnkey solution, you can spend less time and resources on fulfilling the day-to-day process involved in the lending lifecycle. This enables you to focus on the strategic profit–determining decisions.

Check out the Onyx IQ website to learn more about our lending platform, or reach out to us at info@onyxiq.com. If you’d like to give it a try, schedule your Onyx IQ demo today.